Life Insurance: Protecting Your Priorities

No one enjoys thinking about the inevitable fate that awaits us all. However, the thought can be less daunting knowing that your loved ones will continue to be cared for after you are gone. With the right Life Insurance, your beneficiaries will be provided with both long-lasting financial security and peace of mind. Your Life Insurance policy can help to pay for unexpected expenses such as funeral costs, housing payments, medical bills, education, and even prior debt. Helping your family maintain their current lifestyle and ease their financial worries is the primary intention of Life …

Life Insurance: Protecting Your Priorities Read More »

playing a board game without reading the rules. While you may feel the need to be “covered” and get in the game, some of the important details may get overlooked. Not fully understanding your auto insurance can lead to further confusion and frustration later on. The more informed you are, the better choices you will make. Below are some common “TRUE or FALSE?” statements to consider when buying car insurance.

playing a board game without reading the rules. While you may feel the need to be “covered” and get in the game, some of the important details may get overlooked. Not fully understanding your auto insurance can lead to further confusion and frustration later on. The more informed you are, the better choices you will make. Below are some common “TRUE or FALSE?” statements to consider when buying car insurance.

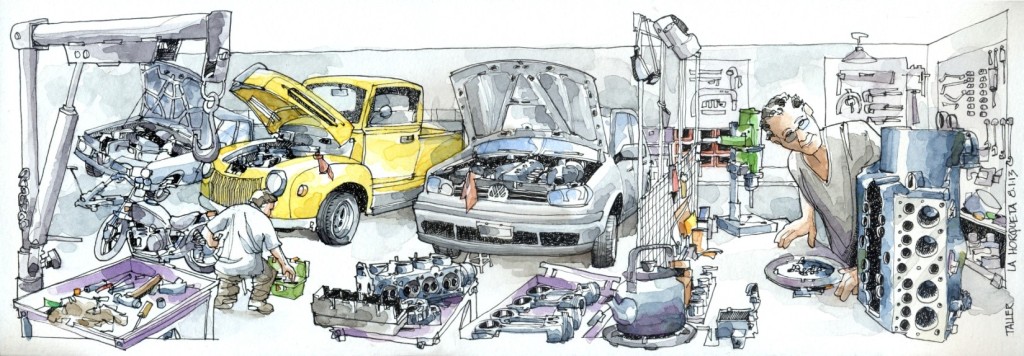

If you own a business, you understand the value and importance of your employees. You also understand the needs of protecting your own employees with Worker’s Compensation Insurance. Simply known as “workers comp” — this type of insurance will protect both your employees and your business from various on-the-job mishaps. Although subject to specific terms and conditions, Worker’s Compensation can cover financial obligations such as:

If you own a business, you understand the value and importance of your employees. You also understand the needs of protecting your own employees with Worker’s Compensation Insurance. Simply known as “workers comp” — this type of insurance will protect both your employees and your business from various on-the-job mishaps. Although subject to specific terms and conditions, Worker’s Compensation can cover financial obligations such as:

vehicle of choice is, it is important to make

vehicle of choice is, it is important to make