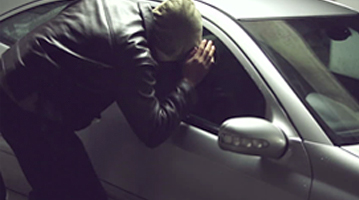

If you can see 5 cars — 1 of them probably doesn’t have insurance (statistically speaking)

Here’s the scenario; You were in a car accident, and it’s not your fault! (that felt more like a commercial?!?) — the other person wasn’t able to pay their bills the last couple months and doesn’t have any insurance. Often it’s not only the uninsured individual who can cause risk, but also the under-insured individual. If someone has the bare minimum insurance and your accident has more than the bare minimum of costs — this is not the situation any of us want.

Unless you live in Virginia, it’s illegal to drive a car without insurance. Every state has their …

playing a board game without reading the rules. While you may feel the need to be “covered” and get in the game, some of the important details may get overlooked. Not fully understanding your auto insurance can lead to further confusion and frustration later on. The more informed you are, the better choices you will make. Below are some common “TRUE or FALSE?” statements to consider when buying car insurance.

playing a board game without reading the rules. While you may feel the need to be “covered” and get in the game, some of the important details may get overlooked. Not fully understanding your auto insurance can lead to further confusion and frustration later on. The more informed you are, the better choices you will make. Below are some common “TRUE or FALSE?” statements to consider when buying car insurance.