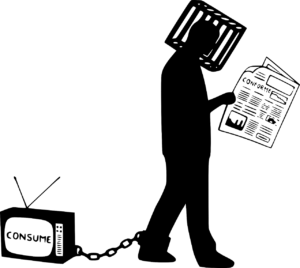

Stay out of self-imposed exile (debt)

Whether we have a little money or a lot — it is the commodity of our time. One of the great trials of handling money is it that it is a science which can be learned, but it doesn’t come naturally to everyone. If you have had past (or present) troubles with saving money and handling debt, here is a quick and simple guide to get you started.

Money uses Math — the addition and subtraction kind of math.

Be encouraged — you have the skills! There is nothing about budgeting that is too complex… it just takes time and will power (and usually a written plan). Budgeting uses the same calculation as dieting, because it’s all about how much you take in and how much you give out. If we want to lose weight we have to burn more calories than we take in. If we want to have more money left over the day before we get our paycheck, then we will need to spend less than we make. Even though it is simple — it’s not always easy. This is where our will power comes in to play, but that’s a whole different blog post :-).

Be encouraged — you have the skills! There is nothing about budgeting that is too complex… it just takes time and will power (and usually a written plan). Budgeting uses the same calculation as dieting, because it’s all about how much you take in and how much you give out. If we want to lose weight we have to burn more calories than we take in. If we want to have more money left over the day before we get our paycheck, then we will need to spend less than we make. Even though it is simple — it’s not always easy. This is where our will power comes in to play, but that’s a whole different blog post :-).

To ease the planning part of this, here is a simple guide to help get us started.

BUDGET EQUATION:

Income minus expense = money you are supposed to manage (and management includes more than spending)

- Know how much money you give out each month. Whether your goal is a trip next summer, or just that you’re tired of having to make your decisions based on how much money you have available at that moment. It is vital to know how much you’re spending. It is one thing to lower your debt, but knowing how much money you have going out (expenses) every month must be controlled, or debt will continue to sneak up on you. You can’t ever make more than you’re capable of spending.

- Know how much money you make each month… exactly. We realize this sounds silly, because — how can anyone go to work every day and not know what they’re making. The reality is that most of us don’t track what is on our paychecks. We are typically so happy to see money in the account that we don’t take the two minutes per paycheck to look at the stub and make sure the amount is accurate. Know how much you put in your bank and what frequency it is delivered.

Even though there are a number of other tools that help with budgets and tracking money, the above info is what goes into a budget. This is as simple as what you make (income) minus what you spend (expenses), and the remainder is what you have to give and save and spend.

**if you are finding that you have less money than you need after doing this “money earned & money spent” equation — that is when you need to bring your expenses inline with your income. Sometimes budgets aren’t fun to do, because we want to pretend that we should live like we are richer than we actually are*** (sorry)